March, 2019

ICE Equity Derivatives Report

March 2019 Highlights

ICE: The leading venue for MSCI index futures

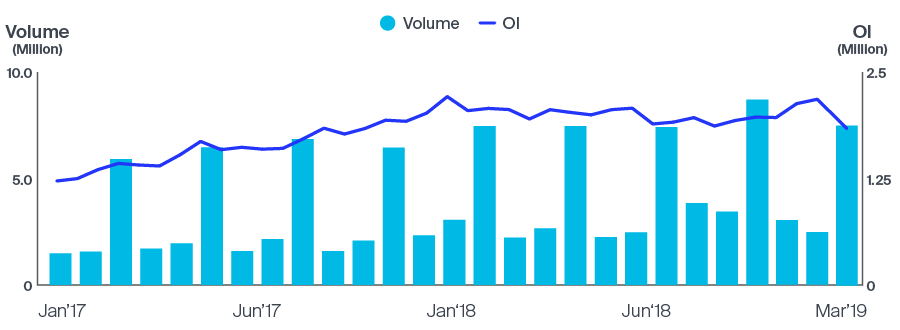

ICE has long been the venue of choice for trading MSCI Emerging Market Index Futures (BBG code: MESA), with open interest reaching an all-time high of 1.59 million contracts ($83.4 billion in notional) and average daily volume up 18% quarter-on-quarter to reach 153,350 (over $8 billion in notional) in Q1 2019.

On April 8, ICE added to its offering with the listing of new index futures contracts to provide market participants additional opportunities to trade developed market equities with granularity around countries and sectors:

- 11 MSCI EMU Sector Index Futures* on ICE Futures Europe, that enable investors to adjust their exposure to the European Economic and Monetary Union sectors; these contracts complement the MSCI World Sector and MSCI Europe Sector Index Futures already available on ICE Futures Europe

- 8 MSCI Index Futures contracts on ICE Futures U.S. that increase the Exchange’s coverage of developed markets. We now have all the building blocks of the MSCI World Index on our platform including: MSCI North America, MSCI Europe and MSCI Pacific Index

- For the new contracts on IFUS, margin offset will be available against the MSCI EAFE Index Futures (BBG code: MFSA) which saw a record volume day on March 11 with 337,277 lots traded. As of the end of March open interest was more than 317,000 lots (over $30 billion in notional)

All relevant information for the ICE MSCI Index Derivatives is available under BMSI <GO> on your Bloomberg terminal.

*not CFTC approved

ICE: The home of UK equities

ICE offers a broad suite of highly liquid, cost-effective and margin efficient tools spanning FTSE 100, FTSE 250 and single stock options for managing UK equity risk:

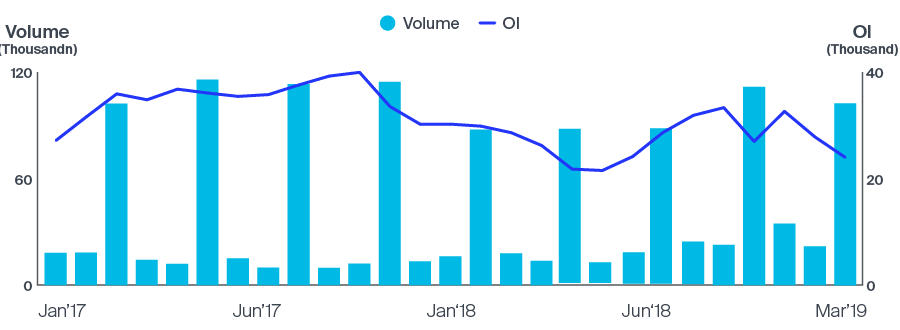

- FTSE 250 Index Futures ADV up 40% QoQ

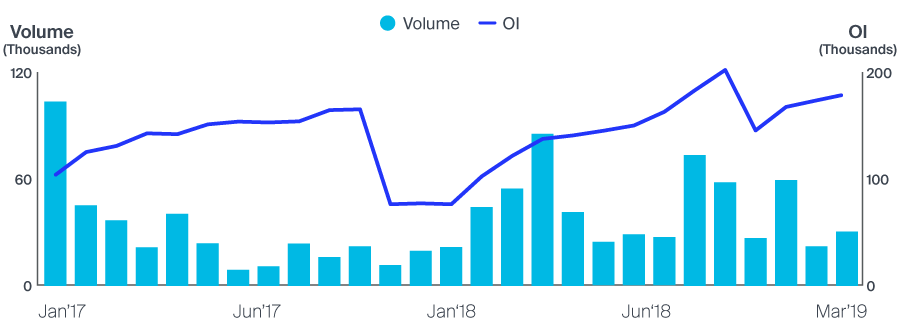

- FTSE 100 Dividend Futures OI up 46% QoQ

- FTSE Weekly Options ADV up 1,100% QoQ

- FTSE trade at Index Close (TIC) 5,441 lots traded since launch in January9

NYSE® FANG+™: trade the top of the tech

- FANG+ Futures averaged 1,143 contracts/day in March, up 53% over February.

| March Futures | ||||||

| Mar'19 ADV | Mar'18 ADV | change | Mar'19 OI | Mar'18 OI | change | |

| FTSE 100 | 195,768 | 220,997 | -11.42% | 682,181 | 640,368 | 6.53% |

| FTSE Dividend | 1,478 | 2,052 | -27.96% | 183,764 | 126,293 | 45.51% |

| FTSE 250 | 4,144 | 3,375 | 22.80% | 21,829 | 27,093 | -19.43% |

| MSCI | 363,978 | 319,613 | 13.88% | 2,054,548 | 2,011,519 | 2.14% |

| SSF | 221,403 | 242,202 | -8.59% | 3,834,372 | 1,632,082 | 135% |

| March Options | ||||||

| Mar'19 ADV | Mar'18 ADV | change | Mar'19 OI | Mar'18 OI | change | |

| FTSE 100 | 51,736 | 52,591 | -1.63% | 1,910,453 | 2,224,051 | -14.10% |

| FTSE 250 | 30 | 39 | -23% | 3,170 | 2,970 | 7% |

| FTSE Weekly Options | 248 | 11 | 2171% | 639 | 2,800 | -77% |

| Single Stock | 49,351 | 58,513 | -15.66% | 3,217,960 | 3,962,586 | -18.79% |

| Q1 Futures | |||

| Q1 2019 ADV | Q1 2018 ADV | change | |

| FTSE 100 | 132,286 | 150,776 | -12.26% |

| FTSE Dividend | 1,915 | 1,358 | 41.00% |

| FTSE 250 | 2,135 | 1,524 | 40.13% |

| MSCI | 209,924 | 187,988 | 11.67% |

| SSF | 120,389 | 193,000 | -38% |

| Q1 Options | |||

| Q1 2019 ADV | Q1 2018 ADV | change | |

| FTSE 100 | 51,786 | 54,540 | -5.05% |

| FTSE 250 | 10 | 28 | -63% |

| FTSE Weekly Options | 153 | 12 | 1134.32% |

| Single Stock | 48,008 | 59,076 | -19% |

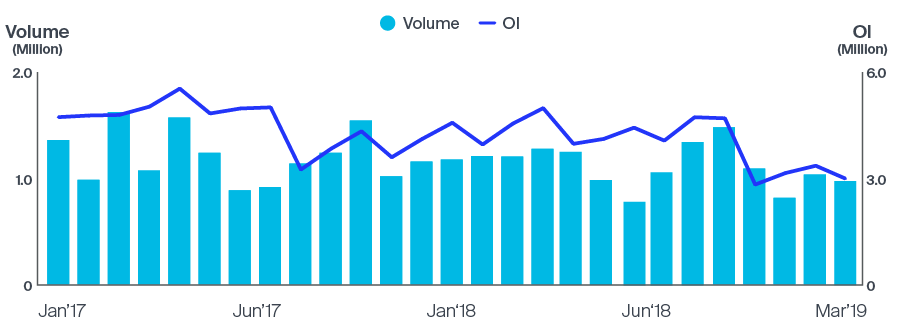

MSCI Index Futures

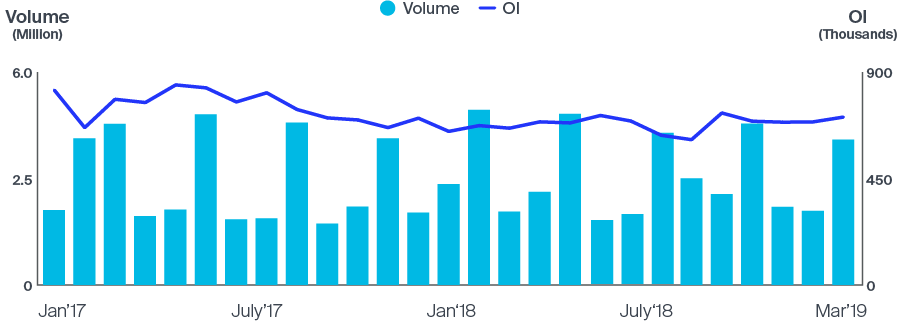

FTSE 100 Futures

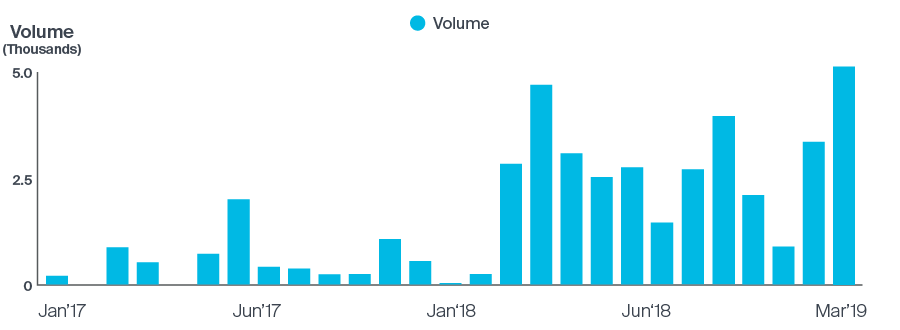

FTSE 250 Index Futures

FTSE 100 RDSA Dividend

FTSE 100 Weekly Options

Single Stock Options

Key Information Documents for certain products covered by the EU Packaged Retail and Insurance-based Investment Products Regulation can be accessed on the relevant exchange website under the heading “Key Information Documents (KIDS)”.

© 2019 Intercontinental Exchange, Inc. All rights reserved. Intercontinental Exchange and ICE are trademarks of Intercontinental Exchange, Inc. or its affiliates. For more information regarding registered trademarks see: intercontinentalexchange.com/terms-of-use