2020 in Review

ICE ETF Hub

Simple. Efficient. Transparent

ICE ETF Hub Report | 2020 in Review

2020 was a year like no other. The pandemic stressed financial markets and heightened volatility. During this time, ICE ETF Hub adoption increased. Market participants needed efficiencies to meet market demands and the Hub delivered by automating the ETF creation and redemption process, and streamlining workflows. The Hub was tested by extraordinary volatility and proved to be reliable and resilient.

We launched several key enhancements including Financial Information eXchange (FIX) access to issuers, market makers and authorized participants; custom basket negotiation technology; and multi-order functionality and connectivity between the ETF Hub and ICE FI Select. We launched a pilot program, welcoming many more authorized participants and market makers to the platform.

In 2021 we will continue our mission of offering a more standardized and simplified process for ETF creation and redemption for the ETF primary market. Look for enhancements to the custom basket workflow, issuer direct workflow and possible expansion to other regions. We look forward to your continued partnership in the year ahead.

2020 in Numbers

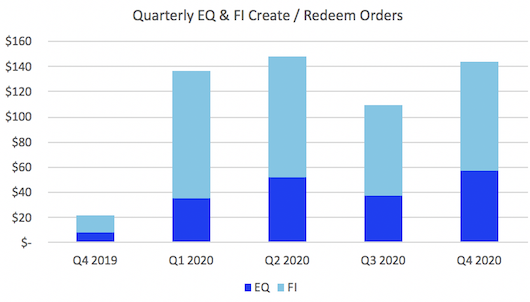

2020 Equity and Fixed Income Notional Activity

ICE ETF HUB COMMUNITY UPDATES

In Q4 we launched phase 1 of the issuer direct workflow; a new workflow that allows market participants (e.g. issuers, custodians, distributors etc.) to use the Hub as their platform to manage creation and redemption orders, providing efficiency and innovation to their customer base.

Launched phase 2 of the issuer basket tool, allowing issuers the use of the custom basket workflow for redemption baskets and set custom parameters around the screening of lists during basket requests. Issuers can now negotiate with security-level feedback directly via the Hub and communicate basket details with their order management system (OMS) through enhanced communication functionality.

Launched the market maker order entry. Market makers can now enter orders through the Hub and route the orders to an authorized participant for order placement to an issuer. Market makers can also view an order blotter and check on a summary status of all orders submitted to an authorized participant.

Custom basket facilitation FIX API was completed in Q4 to support custom basket negotiation electronically through indication of interest (IOI) request message.

Looking ahead to Q1, we will continue to focus on: the issuer direct workflow and onboarding additional clients to the standardized FIX APIs; building out the issuer basket tool based off issuer pilots and feedback of the features; and expanding market access controls, allowing risk limit checks to be performed when orders are placed within the platform, both through the interface and FIX flows.

INSIGHTS FROM THE STREET

Research, insights and more from the ICE ETF Hub community.

NYSE Active ETF Newsletter: 2020 Year in Review

Looking for more ETF market insights? Visit the homeofetfs.com to hear from issuers and access the New York Stock Exchange’s latest newsletter reviewing the “Year of Active” in ETFs. While you’re there, sign up for the NYSE Active ETF newsletter to stay up to date on the key developments fueling the rise of active management in ETFs.

Interested in hearing more about the ICE ETF Hub?