August 2020

Mini U.S. Dollar Index®

Subscribe to this Newsletter

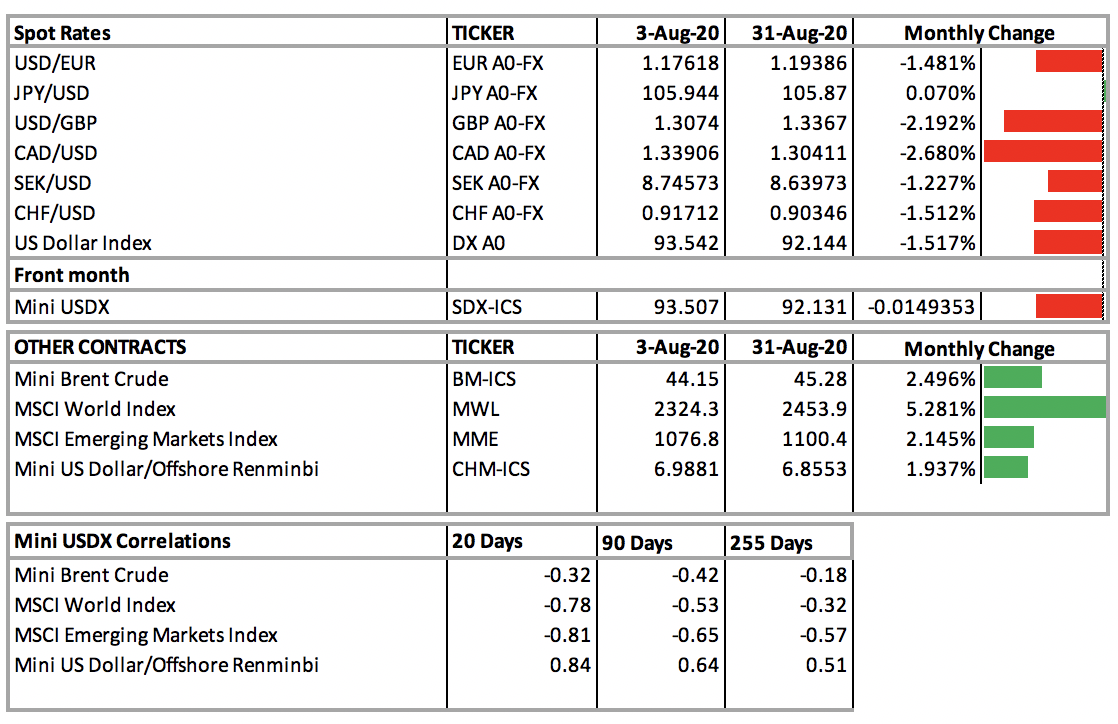

- The dollar turned in its worst August performance in five years. It is the fourth month in a row the greenback has posted a decline, the longest streak in three years. Much of the fall came in the last few trading days of the month after Fed Chairman Powell discussed keeping interest rates lower for longer and potential resultant inflation. The ICE U.S. Dollar Index® (USDX) fell during August to its lowest level since May 2018, trading briefly below 92 on August 31 before recovering. For the month, the index declined 1.39%.

- Several currencies rose to multi-year highs versus USD in August. In Europe, EUR climbed about a 1½ cents on month to over $1.1950, the highest level since May 2018. Similarly, CHF hit a six-year high on the last trading day of the month, with the franc briefly moving through 0.90. NOK rose to an 18-month high of 8.67, just five months after touching an all-time low of 12.13 per dollar. Finally, GBP had one of the better absolute performances versus USD, moving high by almost 3 cents to $1.3375.

- In Asia-Pacific, the dollar had more of a mixed performance. JPY ended the month almost unchanged against the dollar, but the yen experienced significant intra-month movement punctuated by Prime Minister Abe’ resignation for health reasons on the 28th. Better economic numbers gave a boost to CNY, which left the psychologically important 7 per USD level behind in July and steadily improved throughout August, ending at 6.85. NZD and AUD posted solid gains against USD, up 1½ and 2½ cents respectively.

- Elsewhere, CAD picked up about 2½ cents on USD as oil and other commodity prices continued to improve in August. The dollar best performance came against emerging market currencies, but even here, USD gains weren’t uniform. MXN posted a small monthly on better trade news. Likewise, INR showed a slight gain despite weaker than expected economic number and rising COVID-19 cases. TRY continued to slide, falling about 5% for the month to 7.40 per dollar. BRL lost 4% to the dollar as it too has rising COVID-19 cases plus economic woes pushing interest rates in Brazil to record lows.

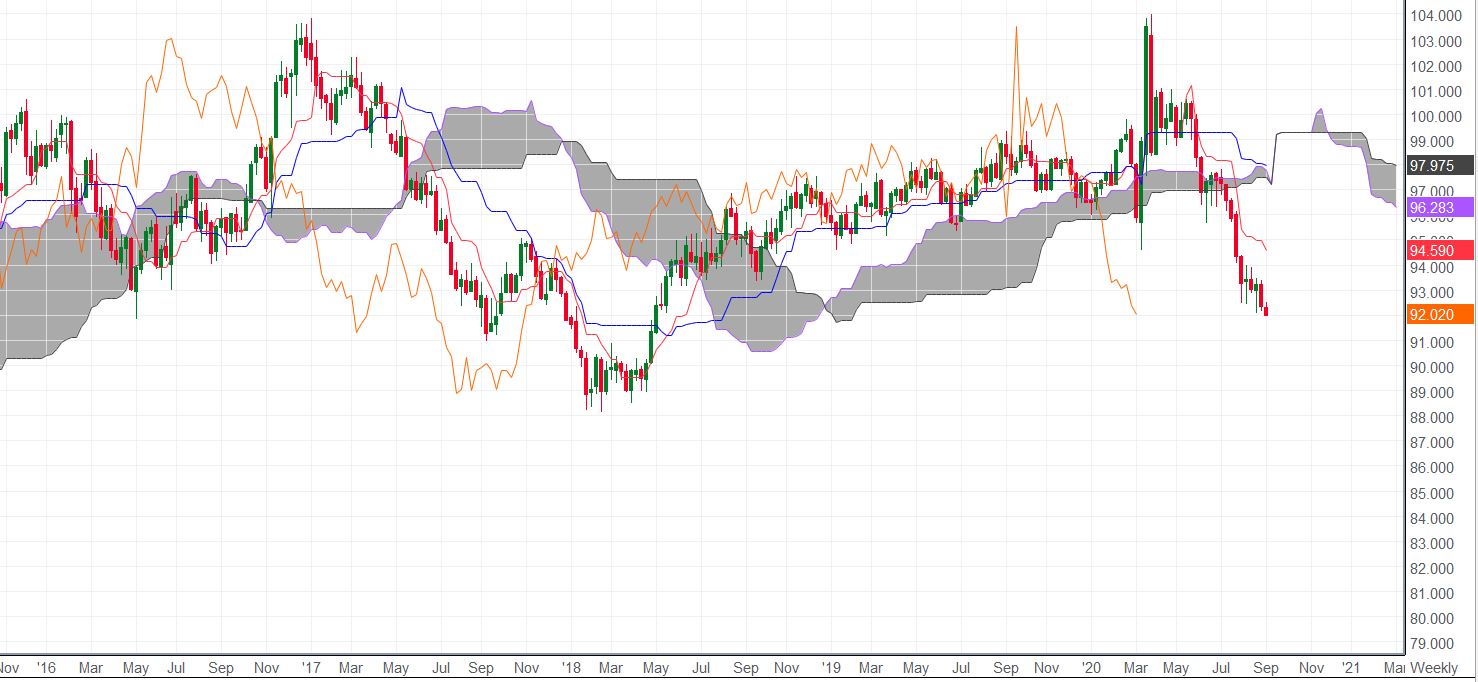

Mini USDX® Front Month Performance (Current Year - Weekly) with Ichimoku Analysis

Hedging the U.S. Dollar in a Single Transaction

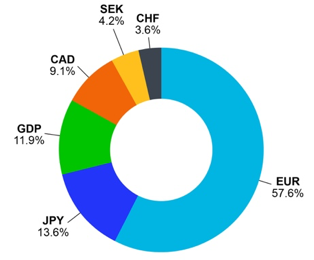

The Mini USDX® Futures contract offered by ICE Futures Singapore can be used to trade the ICE U.S. Dollar Index®. The ICE U.S. Dollar Index® (USDX®) futures contract is used by market participants to gain exposure to or hedge moves in the U.S. dollar relative to a basket of world currencies, in a single transaction.

- Has a contract size of US $200 x index value

- Helps achieve cost efficiency

- Is accessible 22 hours a day

Customers in Asia can benefit from ICE Futures Singapore’s secure, regulated futures trading and clearing services. With local regulation and regional trading opportunities across financial and commodity futures, you can access markets locally that trade around the world.

Limitations

This document contains information that is proprietary property of Intercontinental Exchange, Inc. and/or its affiliates, is not to be published, reproduced, or used without the express written consent of Intercontinental Exchange, Inc. and/or its affiliates.

This document is provided for informational purposes only. The information contained herein is subject to change and does not constitute any form of warranty, representation, or undertaking. Nothing herein should in any way be deemed to alter the legal rights and obligations contained in agreements between Intercontinental Exchange, Inc. and/or any of its affiliates and their respective clients relating to any of the products or services described herein. Nothing herein is intended to constitute legal, tax, accounting, investment or other professional advice.

Intercontinental Exchange, Inc. and its affiliates, makes no warranties whatsoever, either express or implied, as to merchantability, fitness for a particular purpose, or any other matter. Without limiting the foregoing, Intercontinental Exchange, Inc. and its affiliates makes no representation or warranty that any data or information (including but not limited to evaluations) supplied to or by it are complete or free from errors, omissions, or defects.

Trademarks of Intercontinental Exchange, Inc. and/or its affiliates include: Intercontinental Exchange, ICE, ICE block design, NYSE, ICE Data Services, ICE Data and New York Stock Exchange. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located at www.intercontinentalexchange.com/terms-of-use. Other products, services, or company names mentioned herein are the property of, and may be the service mark or trademark of, their respective owners.

“U.S. Dollar Index®” and “USDX®“ are trademarks and service marks of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by ICE Futures Singapore in connection with the Mini USDX® Futures contract. The Mini USDX® Futures contract is not sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the advisability of investing in securities or futures contracts, and any such investment based upon the performance of the Index particularly, or the ability of the Index to track general stock market performance.

ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES