Midday Market Observations

Strong US jobs report, China continues to slow, Europe imposes steel tariffs.

Corporate Bonds | Securitized Products | Municipal Bonds

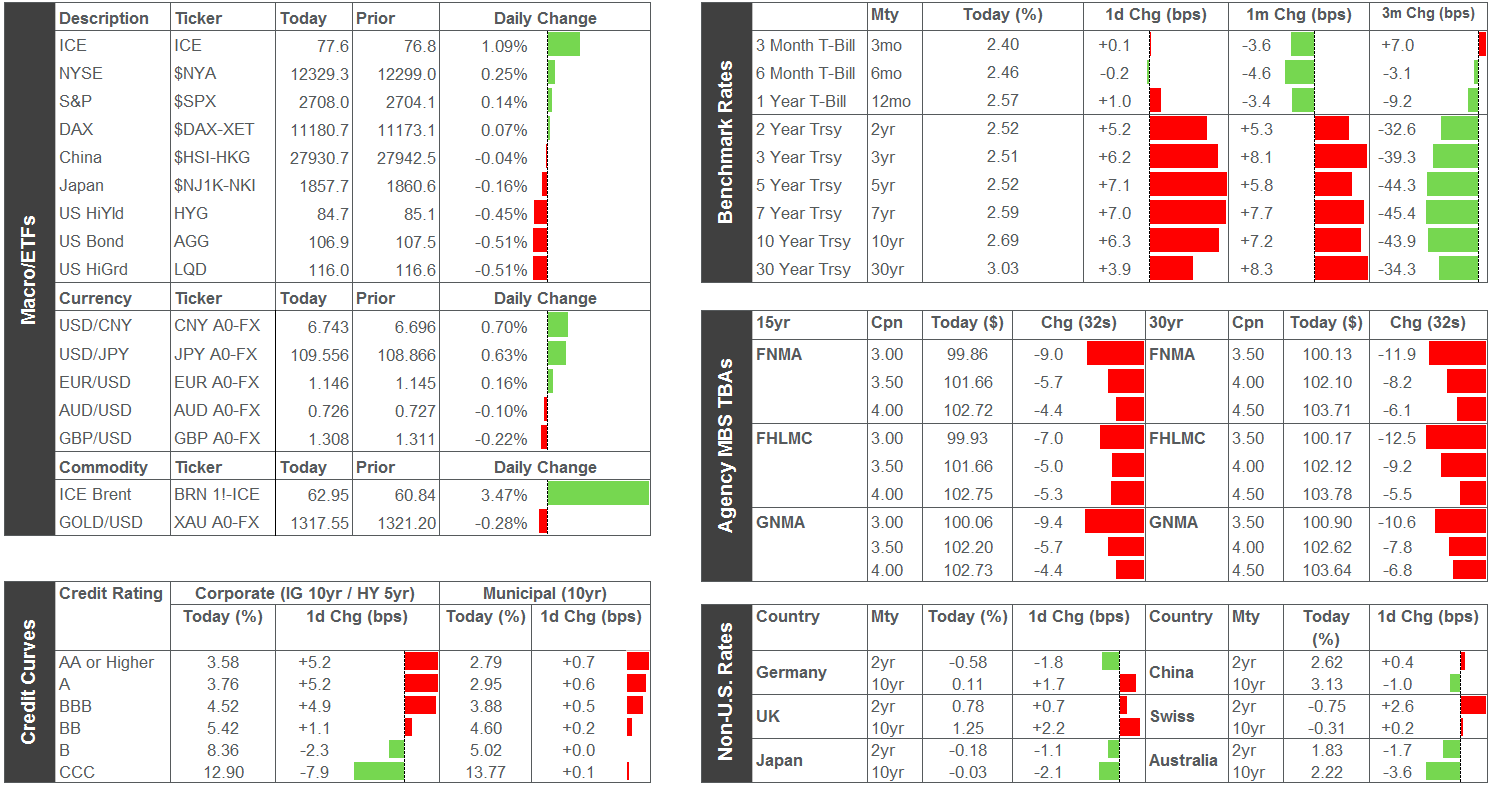

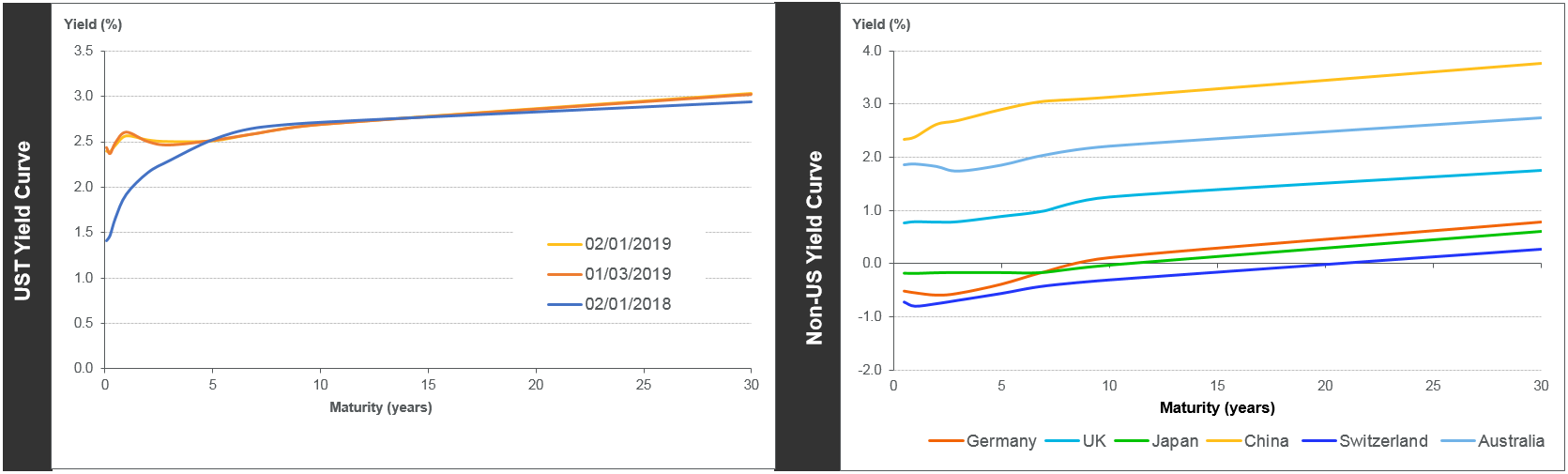

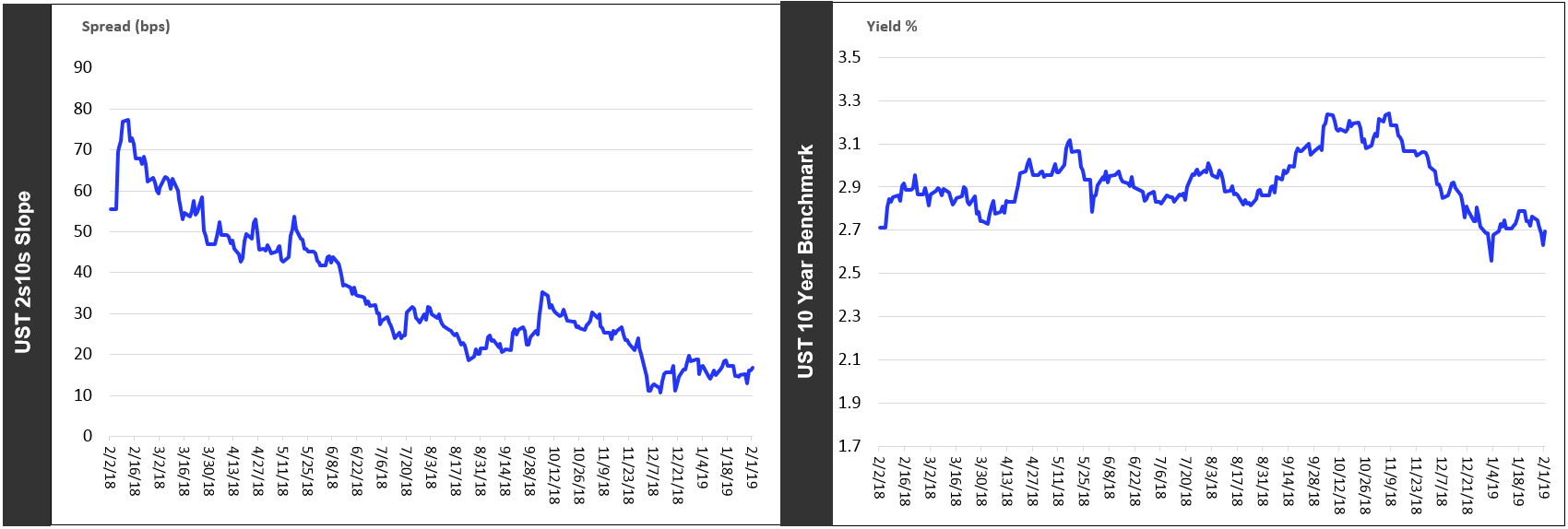

The US added 304,000 new jobs in January, exceeding the estimates of 170,000. The unemployment rate rose to 4.0% last month, rising from a 49 year low last fall of 3.7%. The Labor Department indicated that last month’s partial government shutdown contributed to the rise in the rate, but went on to the say that the shutdown had no “discernable impact” on the payroll numbers. Average hourly wages grew 3.2% on a year over year basis, the best increase since 2009. In the release, December and November’s numbers were revised to show 222,000 and 196,000, respectively. The net revision was lower by 70,000. Non-government payrolls increased by 296,000. Also on the positive front, the Consumer Sentiment Index increased from to 91.2 in January, up from 90.7 the prior month. The upbeat economic news weighed on Treasury yields; the 5 year is 3 basis points higher this morning.In the UK, British factories stockpiled goods at the fastest pace since records began in the early 1990’s. This is in anticipation of a harsh Brexit on March 29. The UK is preparing to resume negotiations with Brussels over the “Backstop” on the Irish border. The pound is 0.14% stronger against the dollar at $1.309. It is off its 3 month high of $1.3218 hit earlier this week. For the month it is up 3% against the dollar, the biggest monthly rise since January 2018.

Separately, The European Union will impose limits on steel coming into Europe following President Trump’s imposition of steel tariffs aimed at China. The concern is that EU markets will be flooded by Chinese excess steel capacity that has been diverted from the United States. The measures concern 26 steel product categories with 25% tariffs taking effect once quotas are filled. There are specific limits for major exporting countries. The euro is trading 0.20% weaker against the dollar at $1.147.

The US Treasury Department has said that non-US entities buying oil or petroleum products from Venezuela’s PDVSA in transactions involving the US financial system must be wound down by April 28. This move is part of sanctions imposed by the United States on Venezuela due to what the US and others call the invalid election of President Maduro. Venezuela is currently scrambling to find new customers for the 500,000 barrels of oil per day it sells to the US. This supply reduction plus the strong US economic numbers are helping to push ICE Brent higher, up 1.33% to $61.66 per barrel. Next week’s economic calendar is as follows:

Monday - Factory Orders;

Tuesday - Balance of Trade (possibly delayed due to shutdown), State of the Union address;

Wednesday - Productivity, Unit Labor Costs;

Thursday - Weekly Jobless Claims, Consumer Credit;

Friday - Wholesale Inventories.